Niklas Hausemann, Katharina Weber and Johannes Block

For decades, hydrogen has been repeatedly traded as the supposed “key element” of sector coupling. Although some of the technologies for climate-neutral generation are still far from being ready for the market, green hydrogen has become an international hype topic. How are potential importing and exporting countries positioning themselves in this regard? And what does this mean for geopolitical power structures and energy dependencies?

Geopolitical dimension of hydrogen

The hype topic hydrogen is said to be able to create a new geopolitical world map. In principle, every country can become a “prosumer” of green hydrogen, i.e. cover at least part of its demand in its own country. The global energy market, it is promised, will thus become more asymmetrical and dependence on oil and coal will be broken. In the case of a green hydrogen market, a contribution will also be made to combating the climate crisis. However, a reorganization of the global energy market also results in the clarification of new energy policy issues. With the emergence of a hydrogen market, the diversification and safeguarding of supply and demand, as well as the consideration of resource and technology availability, must be renegotiated. The potential geopolitical implications of a hydrogen market depend largely on decisions along the value chain. How a country will engage in the hydrogen market depends on the hydrogen production route or supply pathway, application, and transportation. The production of green hydrogen is highly dependent on the natural conditions of a country, while trade between countries is influenced by the geographical but also the security situation of a country.

International interest in hydrogen

In numerous countries, hydrogen technology is seen as having the potential to indirectly electrify sectors that are difficult to decarbonize in the sense of sector coupling, and thus to achieve the climate targets by mid-century. In recent years, this has led to a significant increase in international interest in “climate-neutral” hydrogen production and use. Very large amounts of renewable electricity generation will be needed to meet the projected demand for hydrogen and synthetic fuels in combination with the growing energy demand for direct electrification. Since several of the larger industrialized nations in Europe and Asia currently have limited domestic generation capacity, countries with favorable conditions for renewable generation see an opportunity to generate their own economic growth in the growing hydrogen market through exports. As a result, hydrogen has become an item on the government agenda of many countries. Likewise, many countries with gas exports have a strong interest in blue hydrogen with CO2 capture.

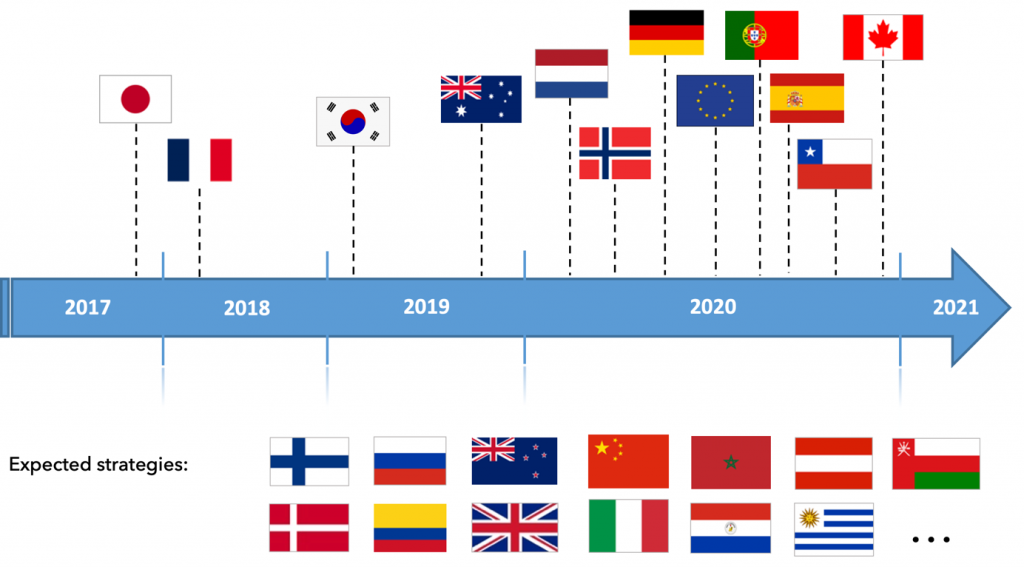

A growing number of countries have already published national hydrogen strategies or are working to develop hydrogen technologies and markets. In addition to the issuance of national hydrogen strategies, the development of research and development programs, vision documents, and roadmaps has also accelerated rapidly in the recent past (Fig. 1). The pioneers in this respect include Japan, France, Australia and South Korea. In addition to individual nation states, the EU is also very active with several publications, including its own strategy paper. Further progress is expected in the EU member states and on the Arabian Peninsula following the launch of the EU strategy. The same applies to the Latin American countries following the publication of Chile’s hydrogen strategy.

As hydrogen technology takes off, new importers and exporters will emerge. In this respect, the strategies reflect the different ambitions and motivations of the countries with regard to their role and participation in a global hydrogen market. Japan, South Korea and Germany in particular explicitly consider the import of hydrogen in their national strategy papers. Early positioning in the new market is also expected to give these countries a head start in technology leadership. Meanwhile, producers and exporters of oil, gas, and coal are considering future hydrogen projects and plans to compensate for the potential geopolitical and economic loss they face as fossil fuels become less important. Due to the existing gas industries as well as good renewable energy potentials, countries that play a dominant role in the fossil energy market (Saudi Arabia, Qatar, United Arab Emirates, Russia, etc.) also have high potentials to participate in this growth market as exporters of blue and green hydrogen. Moreover, they have a suitable geographical location to serve the European and Asian markets. Other potential exporting countries such as Morocco or Australia promise economic growth due to their high generation capacities, but run the risk of delaying the local energy transition by tying up renewable expansion capacities and manpower in the context of a strongly export-oriented hydrogen economy.

The ambitions of individual countries in their strategies reflect their national strengths and weaknesses and related interests. While Germany’s main goal in using hydrogen is climate neutrality, Australia’s strategy paper centers on potential economic growth through global exports. Japan even aims to become a “hydrogen society.” These different main goals are also reflected in the preferred color of the imported or exported hydrogen. While Europe has clearly announced its preference for green hydrogen, Asian markets (South Korea, Japan, China) are pursuing a more diversified gray-blue-green strategy for the coming decades.

The “champagne of the energy transition”

In business and political circles, there are loud voices calling for “technology openness” and thus pointing in particular to the possible use of hydrogen in all sectors. However, the energy efficiency of green hydrogen is often ignored. The fact that about 80 % of the energy is lost when using an electrolyzer (and even about 90 % in the case of synthetic fuels) receives rather less attention. Vast amounts of electricity from renewable generation are thus wasted during electrolysis. In view of the continuing stagnation in the expansion of renewables, this process does not make sense at the moment.

Why not simply import green hydrogen from regions that have a high potential for renewable power generation? North Africa comes to mind for some when considering this question, as usable land and high solar irradiation are available to produce quantities of green hydrogen from solar energy. So what’s the argument against it? The basic idea of building gigantic solar parks is not new, it already failed a few years ago. But it is making a comeback, this time with green hydrogen as output. A relatively small amount of hydrogen would be produced with an enormous amount of energy needs and exported to European countries like Germany, while many parts of Africa remain unelectrified and suffer from water shortages. And would the African population also benefit from such a venture? Because if not, it would be something what Van de Graaf et al. (2020) call “green colonialism.”

Similar plans of a green hydrogen imports from Saudi Arabia are already more advanced. In March 2021, German Economics Minister Peter Altmaier signed a memorandum of understanding together with the Saudi energy and oil minister. Should we really enter into an energy dependency with a country whose human rights situation is more than questionable?

What alternatives are there to green hydrogen? Blue hydrogen, from natural gas using CCS processes to capture the CO2, is also often brought into play. Calling this a “bridge technology” until green hydrogen is available in large quantities can only be seen as an attempt to drag out the phase-out of fossil fuels. How and where the enormous quantities of carbon dioxide are to be safely stored remains unclear. This heralds a new final storage debate. Instead, efforts and financial resources could be invested in domestic production capacities for green hydrogen, or even better – wherever possible – in direct electrification.

Hydrogen as a “key element” of the energy transition?

Not only the climate targets agreed at the 2015 climate conference in Paris are motivating numerous countries to develop hydrogen strategies, but also the loss of importance of fossil fuels. Even the CEOs of the oil giants now admit that “peak oil” is imminent. The massive price drop experienced by oil at the beginning of the Corona pandemic in 2020 impressively showed how fragile the former power of oil has become. Discussions about hydrogen as a supposed “key element” of the energy transition have since gained additional momentum.

For gas and oil exporting countries, the production and trade of hydrogen can be a lifeline in an increasingly decarbonized world in which coal, gas and oil are losing importance. Hydrogen is not only economically lucrative for these countries, as it is also a way to preserve existing geopolitical power and dependency structures of the fossil energy trade. For gas exporters such as Russia, blue hydrogen is particularly interesting, as gas continues to be used in production with CO2 capture. Regardless of the fact that a solution for the permanently safe storage of CO2 is not foreseeable, these countries have great interest in the use of CCS processes. Although there are parallels to existing fossil energy markets – at the very least, a global hydrogen market would be more asymmetric and diverse due to the potential for generation at more worldwide locations.

Hydrogen will play a role in sector coupling because direct electrification is not possible for example in certain chemical industry processes. It is also conceivable that it could be used in long-term storage and in synthetic fuels for aviation and shipping. Nevertheless, the steady improvements in battery storage systems in terms of capacity, lifetime and environmental friendliness are increasingly making hydrogen a non-essential and inefficient energy carrier. Against the backdrop of all geopolitical implications, energy efficiency and the obvious alternative to energy supply, it becomes clear: Sector coupling must be based primarily on direct electrification with storage systems and a decentralized and renewable energy supply.

Niklas Hausemann, Katharina Weber and Johannes Block study Geography (M. Sc.) at the University of Bonn. Niklas Hausemann is research associate and project manager at EUROSOLAR.